uber eats tax calculator uk

Sign in to order delivery with Uber Eats. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it.

Two-day cashout previously called Flex Pay Get your earnings within two business days when you cash out in the app before 1400 Monday to Friday.

. 20 Income tax for the next 37700. The 58p VAT adjustment is due to Uber charging the client VAT on the 350 delivery rate. Uber also issues quarterly statements which dont line up with the above.

Not for customers 27k. Use the Uber price estimator to find out how much a ride with Uber is estimated to cost before you request it. Uber fares across the UK are to rise sharply from Monday night when VAT of 20 will be applied to rides booked via the app.

In comparison with taxi drivers Uber Eats drivers are only required to register collect and remit sales tax on an ongoing basis regardless of whether they have earned 30000 in revenue during their last 4 quarters. Get your earnings within minutes when you cash out in the app. 30 fee for delivery orders.

Go to the tab Invoice Settings. If you are responsible to collect sales tax based on this threshold you will need to provide Uber Eats your HSTGST registration number. Virgin broadband just 18month.

We are taxed as small business owners. Cash out anytime once per day. One thing to understand is that Uber Eats does their tax documents like 1099 forms kind of funny.

In all UK cities a variable fee based on trip distance time and other factors is added to each trip. You can include your profit from riding in Uber cars ordering groceries through Uber. The 58p VAT Adjustment arises from where Uber charges the customer VAT on the 350 charge for the delivery.

We match your Uber ad spending up to 100 per month². As a VAT-registered Dutch company Uber can classify its exports to the UK as intra-community services and hence VAT-free as long as Uber can show that the retailer is VAT-registered. The amount of tax and national insurance youll pay will depend on how much money is left over after deducting your Uber expenses tax allowances and reliefs.

They refund the VAT back to the merchant for the reasons mentioned above. First published on Fri 11 Mar 2022 1319 EST. Do I just divide by 4 to get weekly.

Your car expenses can reduce your taxable income by thousands. The average number of hours you drive per week. 6 fee for pickup.

How the HMRC mileage will be calculated for food delivery driver like Uber eat. Uber pays weekly which is great for you spreadsheet. There is no requirement in the UK to register as a driver for Uber and Ubereats after their registration is completed thus paying taxes at the end of the year as a self-employed.

950 per hour if you drive your own car. This sub is exclusive to talk about UberEats drivers issues and memes. 0 fees if you dont get at least 25 orders¹.

Uber Eats Fee-18024 should be 180174 at 30 Net Sales 42034 VAT adjustments - 2326 which is added back to the net sales for some reason Total Payment. Here is the table that shows the rate of income tax on the trading profit in the bracket. No tax for the initial 12570 personal allowance 50270- 12570 37700.

Cash out anytime up to 5 times per day. 40 Income tax on the remaining 100. Get a cost estimate now.

Please note some banks may take more time to process deposits. I have spent a little time creating an iOS Shortcut that will help you to calculate the amount of tax you need to. Hi all UK delivery driversriders.

Press J to jump to the feed. Income tax starts at 20 on all your income not just from Uber over 12500 and 40 over 50000. They report different income than what was deposited in your bank account and the uber tax summary can be confusing.

Bike scoot. How the HMRC mileage will be calculated for food delivery driver like Uber eat. Once youve tried it out check out our list of 16 Uber driver tax write offs to see how you can save more on your year-end taxes thereby increasing your true profit.

Under the reverse charge system the merchant needs to account for VAT. Here are the 9 important concepts you need to know about taxes as an Uber Eats delivery contractor. Your business will be shown higher in the home screen and search results of the Uber Eats app.

Uber Eats Taxes are based on profits. How is this handled. There is no calculator to estimate Uber Eats delivery fees outside of the Uber Eats app itself.

How to Calculate Your Tax. With our tool you can estimate your Uber or Lyft driver taxes by week month quarter or year by configuring the calculator below based on how much and how often you plan to drive. What Uber Eats paid you and what they say they paid you are two different numbers.

UK interest rates up to 125. Phone is monthly 110 total. You can log into your Uber profile and input your number by following these instructions.

How Much Tax Do You Pay On Uber Eats. For purposes of this tax calculator just use the total money you actually received from Uber for the year. Fri 11 Mar 2022 1508 EST.

Drivers who earn Uber earnings are not taxable and as a result HMRC requires an accountant to file a tax return on behalf of them. Alternatively it could be because the delivery driver isnt VAT registered and therefore it is not fair for the merchant to have to pay the output VAT on the.

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How To File Taxes For Uber As An Independent Contractor Filing Taxes Independent Contractor Uber Driving

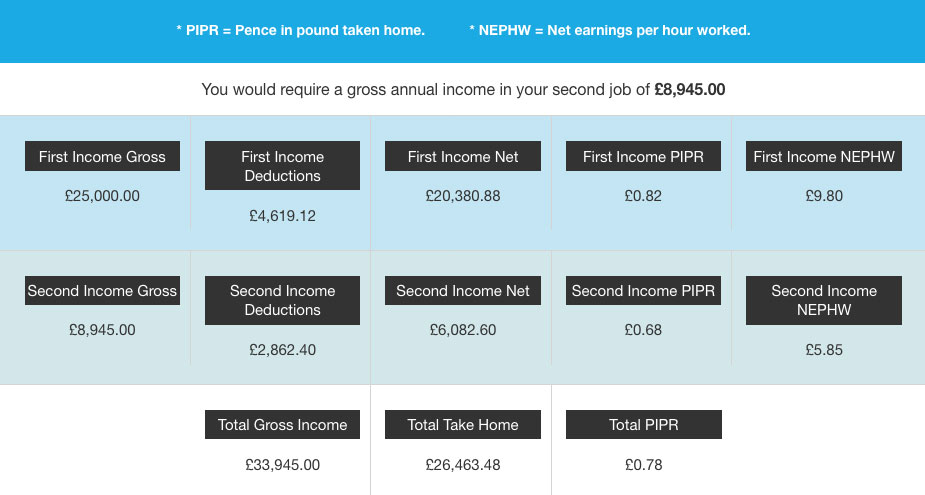

How Much Pay Can You Take Home From An Additional Income Uk Tax Calculators

61 235 Tax Return Photos Free Royalty Free Stock Photos From Dreamstime

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How To Calculate A Restaurant Bill Bills Calculator Restaurant

Koinly Blog Kryptowahrung Steuern News Strategien Tipps

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

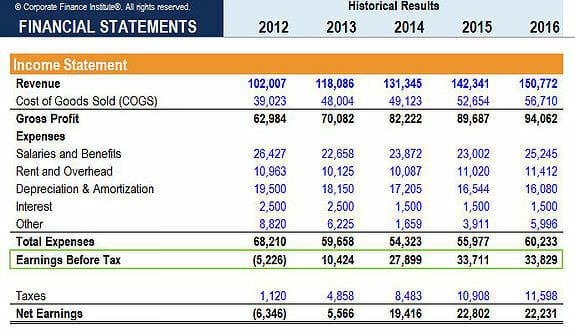

Earnings Before Tax Ebt What This Accounting Figure Really Means

Livrare La Domiciliu Atelier A Primi Uber Fare Calculator Schwarzwald Hotel Org

Calculator And Word Tax Calculation Isolated On Black Background Ad Affiliate Tax Word Calculator Calculation Calculator Words Calculator Photo Editing

Happy Chartered Accountants Day Motivational Picture Quotes Day Wishes Chartered Accountant